With the continuous development of the financial industry and the increasingly competitive situation, to enhance customer experience and improve office efficiency has become the industry's urgent need to focus on the core issues. To change this situation, the first thing to do is to change the existing traditional network, improve network coverage and operating speed. A rural credit union had an outdated network infrastructure and was in dire need of a network upgrade.

Enhance service quality: Network upgrades can improve the credit union's service quality, including improving efficiency, speeding up transactions, and enhancing system stability, so as to better meet customers' needs.

Expand business scope: Upgrading the network can expand the credit union's business scope to cover a wider range of geographic areas and people, providing financial services to more rural residents and promoting rural economic development.

Enhance Competitiveness: In an increasingly competitive financial industry, having an advanced network infrastructure can enhance a credit union's competitiveness, attract more customers and investments, and increase market share.

Enhance information security: Advanced network equipment and security technology can strengthen credit unions' information security protection capabilities, prevent network attacks and data leakage, and protect customers' funds and privacy.

Adapting to Digital Transformation: Today's financial industry is undergoing a digital transformation, and network upgrades are one of the most important steps in achieving this transformation, helping credit unions better adapt to the trends of the digital era and improve business efficiency and innovation.

Information Security Risks: Rural credit unions may face information security risks during network upgrades, including data leakage, cyber attacks, etc. Effective security measures are needed to protect the information security of customers and institutions.

Compatibility with Existing Systems: When upgrading the network, it is necessary to consider the compatibility of the new system with the existing system to avoid problems such as business interruption or data loss due to the upgrade.

Difficulty in infrastructure construction: Infrastructure construction in rural areas lags behind, and network upgrades may be limited by factors such as geography and poor communication facilities, which increase the difficulty and cost of upgrading.

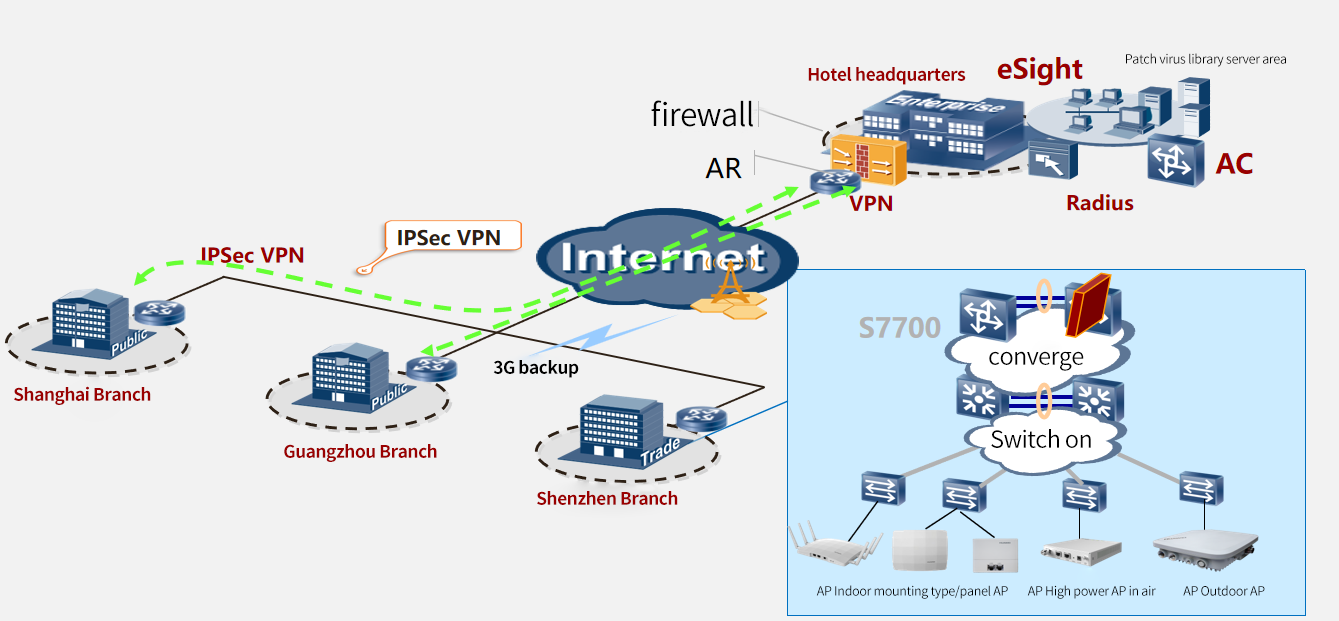

This rural credit union has a total of more than 400 office outlets, the existing network experience is poor, low security, no way to host video conferencing services, seriously affecting the rural credit union's customer experience and office efficiency. We customized and optimized the network upgrade solution for this credit union, and successfully solved the previous network defects.

Rural Credit Union Scenario Solution:

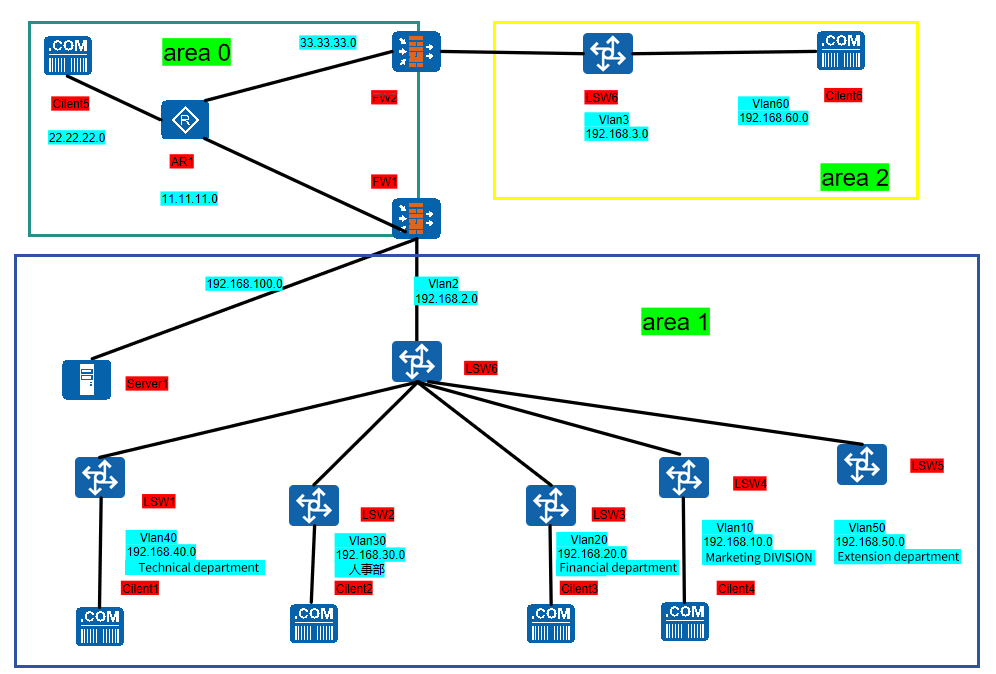

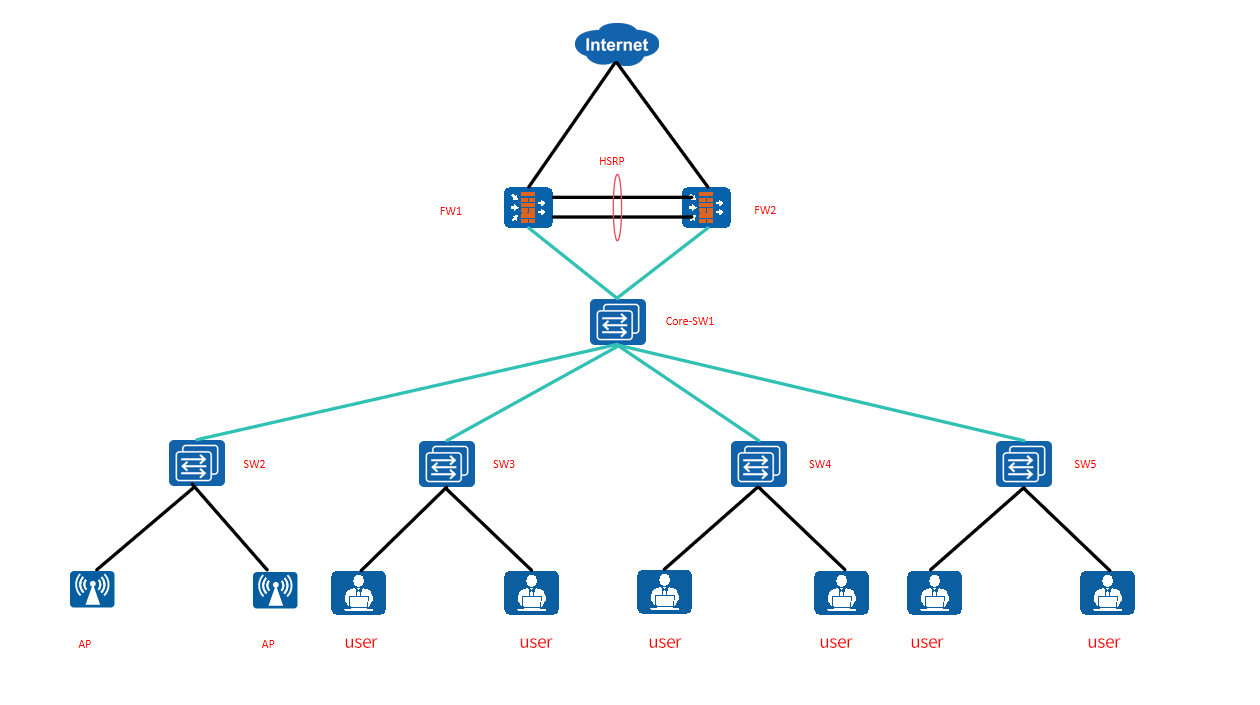

The preferred solution for this rural credit union LAN setup includes Huawei egress firewall USG6625E*2; core switch S6700-24-EI*2; access switches S5735-L48T4X-A1*6 and S5735-S24P4X*2; and wireless AP AirEngine 5762S-11*40.

This Rural Credit Union project incorporates leading technologies in the financial industry, including access control technologies and multiple security certifications, to simplify the Internet experience for users and employees with wired and wireless access, and to improve efficiency with faster Internet access.

At the same time, the network upgrade substantially improves the security of the office network and provides open network services to customers on this basis.

This upgrade program proved Infdevice's strong network planning and technical support capabilities, laying a solid foundation for future network technology solutions business.